- #Hk960m network chinese taptap bilibililiaotechcrunch driver#

- #Hk960m network chinese taptap bilibililiaotechcrunch software#

- #Hk960m network chinese taptap bilibililiaotechcrunch professional#

- #Hk960m network chinese taptap bilibililiaotechcrunch series#

#Hk960m network chinese taptap bilibililiaotechcrunch professional#

Though known for its trove of video content produced by amateur and professional creators, Bilibili derives a big chunk of its income from mobile games, which accounted for 40% of its revenues in 2020. Year over year crime in Denver has increased by 19.

Denver is safer than 62 of the cities in the United States. In Denver you have a 1 in 97 chance of becoming a victim of crime. Violent crimes in Denver are 49 lower than the national average.

#Hk960m network chinese taptap bilibililiaotechcrunch software#

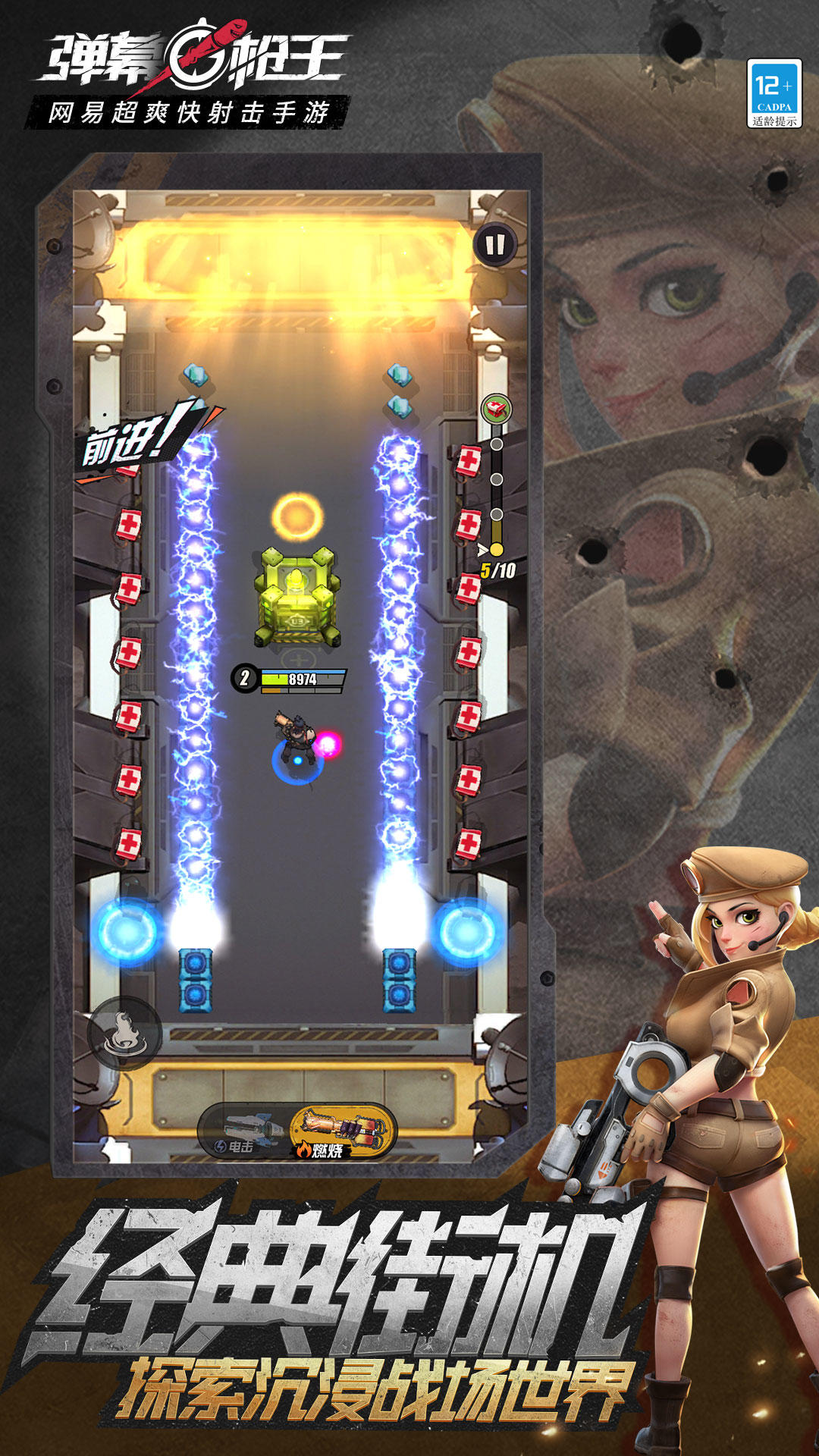

TapTap offers the latest official version 1.0.2 of Learn Chinese Word HD for download This is a learning software on.

#Hk960m network chinese taptap bilibililiaotechcrunch series#

The partners will initiate a series of “deep collaborations” around X.D.’s own games and TapTap, without offering more detail. Denver crime rates are 56 lower than the national average. Learn Chinese Word HD is a Casual mobile games. Network, which runs the popular game distribution platform TapTap in China, the company announced on Thursday.ĭual-listed in Hong Kong and New York, Bilibili will purchase 22,660,000 shares of X.D.’s common stock at HK$42.38 apiece, which will grant it a 4.72% stake. It has agreed to invest HK$960 million (about $123 million) into X.D. Popular video platforms, like us, will all have great opportunities.Competition in China’s gaming industry is getting stiffer in recent times as tech giants sniff out potential buyouts and investments to beef up their gaming alliance, whether it pertains to content or distribution.īilibili, the go-to video streaming platform for young Chinese, is the latest to make a major gaming deal. "The market will be in ultra-high-speed growth for the next several years. Videos "will be a major trend for the internet industry over the next three to five years," Chen told Bloomberg.

#Hk960m network chinese taptap bilibililiaotechcrunch driver#

"Nobody will remember whether your stock went up or down on the debut in 10 years' time."Ĭhen has been seen as the real driver of Bilibili's success in recent years, persuading Chinese tech rivals Tencent and Alibaba to come on board as early investors as well as Sony. "We wouldn't care too much about short-term performance in the stock market," the 43-year-old billionaire told Bloomberg Television in what the network said was his first interview with international media. Often dubbed "China's YouTube", it allows users to upload and share videos with voiceovers and music added and hosts a significant amount of user generated content.įounded in 2009 by a then 20-year-old college student Xu Yi, it began primarily as a place for fans of gaming and anime to gather and share content but has since spread among Gen Z Chinese users.īilibili chief executive Chen Rui played down short term market price drops, billing his company as a website primed to tap into China's nearly one billion internet users. It is a fast growing video streaming site with around 200 million mostly young Chinese users. Last week American regulators announced plans to force Chinese firms to adhere more strictly to its auditing rules, sparking concerns over potential delistings in the US and a global sell-off in Chinese tech shares. US-China tensions remain at the forefront of investor jitters. The Chinese tech homecomings have continued into 2021 but with less investor enthusiasm.Ī Hong Kong debut by Chinese search engine Baidu last week raised $3.1 billion through its IPO but its shares finished flat on the opening day and have since sunk some 15 percent. Last year Hong Kong raked in an impressive $49 billion in IPOs with hugely popular second listings by the likes of JD.com and NetEase.

Over the past 18 months Hong Kong has seen a flurry of Chinese tech firms hold initial public offerings in the city, part of a drive to list closer to home as relations between Beijing and Washington sour. Bilibili's opening price fell just over 6 percent in early trade after the firm raised around $2.6 billion in a secondary listing on Hong Kong's bourse.

0 kommentar(er)

0 kommentar(er)